Disclaimer: We here at BarkPost are by no means finance whizzes. Make sure you consult with a true tax professional when it comes to filing your taxes this year!

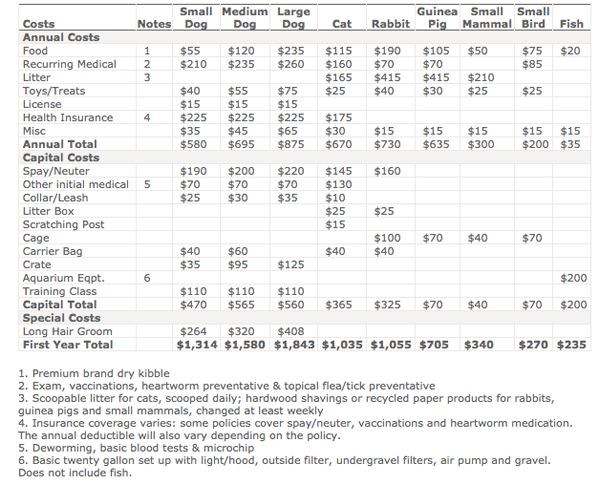

As much as we love ’em, dogs can get expensive. According to the ASPCA, a dog can cost you anywhere from $1,300 to almost $2,000 yearly.

However, we did a little digging online, and we found one way your dog can actually have you SAVE money: Taxes.

That’s right! As you file your yearly taxes with the government, see if these 6 ways can apply to you. Consult with your accountant and who knows? You might actually be able to get a sweet write-off, all thanks to your pooch!

1. If You’ve Moved With Your Pup…

…you can potentially write them off. According to Daily Finance, if you’ve relocated at any point in the past year for work (usually the minimum required distance is 50 miles), you can potentially deduct any moving costs. Since pets are generally legally considered property, this can include what you had to spend to move your pup!

2. Service Dogs

Service dogs can be considered medical expenses, so any legitimate costs spent on them (this includes training, food, veterinary expenses etc) can be tax-exempt. Therapy dogs can also be included in this, as long as you have been officially medically diagnosed with the condition they help you with. However, check with your CPA to see if you meet threshold for medical expenses before you go about deducting anything.

3. Volunteer Work

Whether you’ve adopted your pup, foster a dog, or spend money helping out rescues and/or shelters in any way, shape or form, you may be able to write off these expenses! As long as the organization you’re involved with is a non-profit, you can classify these as charitable donations. Just make sure you keep the pawper documentation, so you can back up your deductions!

4. Guard Dogs

If your pup actually helps to guard a valuable property of yours, and again, as long as you have the paperwork and documentation to back it up, the IRS allows you to write off any related expenses. Keep in mind as well that the breed of your pup may also be key. According to Entrepreneur Magazine, the IRS considers “typical” guard dogs like German Shepherds and Pit Bulls more legitimate than say, a Yorkie.

5. Your Pup Is Your Profession

Whether you are a professional breeder, a pup parent to a dog actor, a trainer, and/or a dog walker, if your pup is literally your job that you generate livable income from, then their expenses can pawssibly be written off. Keep in mind though this is different from pup schtuff that could be considered merely a hobby instead. Make sure to check with a tax professional to see if this applies to you.

6. Pet Food

According to Kiplinger, a couple was once able to write off food that they left on their property for the feral cats that also, incidentally, helped keep the vermin population on their property down. Now, whether or not you can claim this for your own pup (or any strays you feed) is highly determinate, make sure you can REALLY prove it. The couple in this story actually had to go to court to back up their claim.

Make sure you consult with a true tax professional before you attempt any of these write offs! But who knows? Maybe this year is the one where you’ll actually get back some money from the government BECAUSE you have a fuzzbutt!